Purpose & Audience

This guide explains—in plain, beginner‑friendly language—how defining Products the right way powers automation everywhere else: policy creation speed, consistent fees & commissions, accurate payment schedules, cleaner reports, and fewer manual fixes at renewal or endorsement time. Audience: operations admins and any agent who creates or renews policies.

Why Product Definitions Matter

- Speed: Selecting a product auto‑adds transactions & commissions (no retyping fees each time).

- Accuracy: Standard math (fees, interest, down payment logic) happens the same way every policy.

- Compliance: Reduces arbitrary agent changes that create audit noise.

- Reporting: Line, term, and business type fields become reliable filters (no spelling drift).

- Cash Flow Predictability: Smart Payment Matrix pulls defaults (interest, # payments, processing fee) from the product for a correct first schedule.

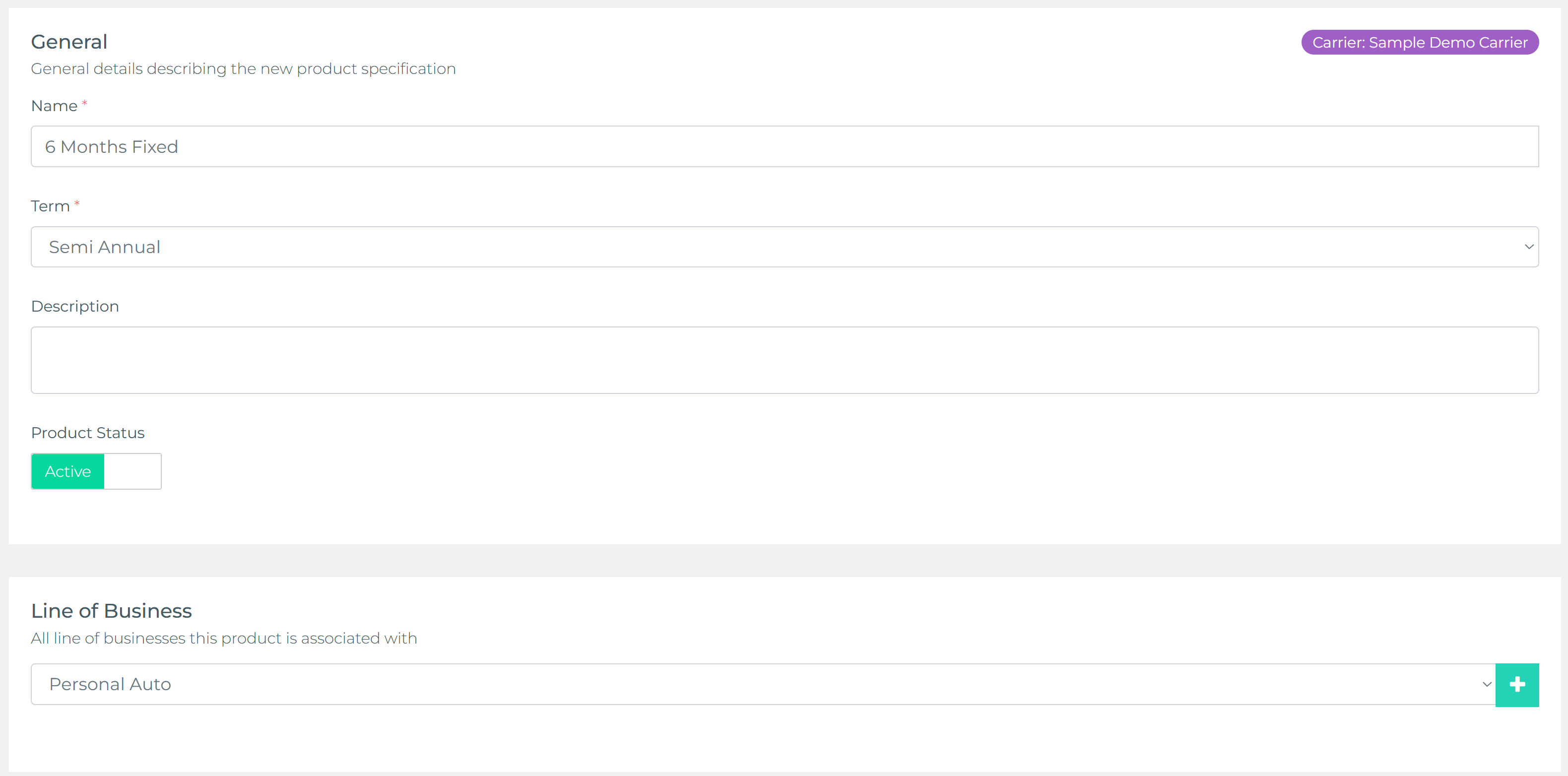

Core Product Fields & Their Impact

- Carrier + Line of Business: Anchor the product to the market + coverage class for analytics.

- Business Types (New, Renewal, Endorsement, Rewrite): Define which transactions & commissions auto‑generate per scenario.

- Allowed Terms & Default Term: Controls the dropdown at policy creation; prevents ad‑hoc term values.

- Default # of Payments & Interest Rate: Seeds the Smart Payment Matrix; agents can still override but start from a safe baseline.

- Fees (policy, processing, finance, service): Centralized here so they post consistently; no hidden “extra” manual line items.

- Commission Rules (Agency & Agent layers): Ensures payout math lines up with revenue recognition.

- Transaction Templates Linkage: Ties each business type to a predefined financial shape (premium portions, fees, commissions).

Step‑by‑Step Modeling Workflow

- Identify Variations: List what actually changes between policies: term choices, commission splits, recurring fees. Each unique combination may justify its own product.

- Define Allowed Terms: Add only real terms (Annual, Semi‑Annual, Quarterly). Remove unused defaults to limit mistakes.

- Attach Business Type Transactions: For each (New, Renewal, Endorsement) assign templates with correct fee + commission structure.

- Set Payment Defaults: Interest (if financing), processing/service fee, default number of payments (e.g., 10). Keep round numbers—avoid odd defaults like 7 unless required by carrier.

- Commission Layering: Enter agency share first, then one or more agent splits. Confirm totals align with carrier statement norms.

- Test via Sample Policy: Create a sandbox policy, select product, verify: transactions populated, commissions correct, schedule generation sensible.

- Refine & Lock: Adjust misaligned amounts, then communicate availability to agents (change log message or internal note).

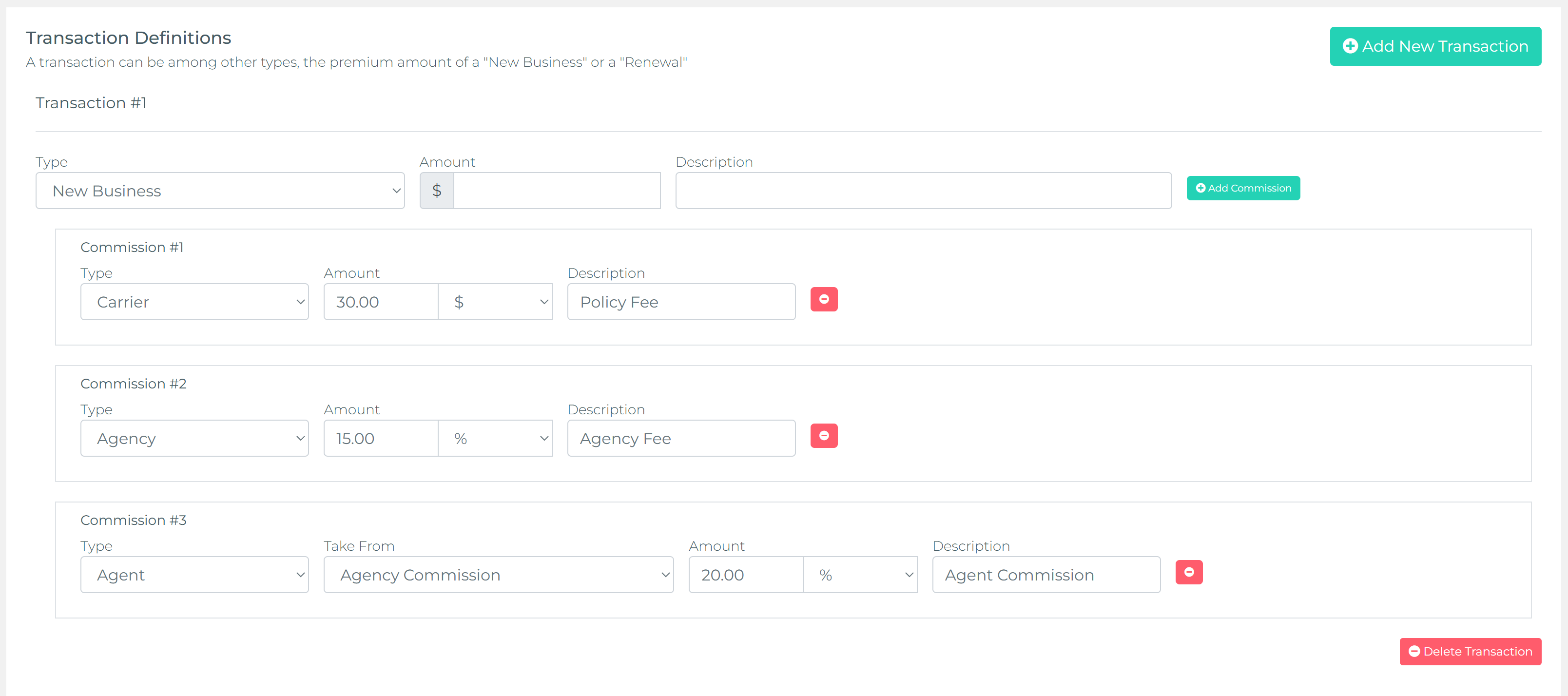

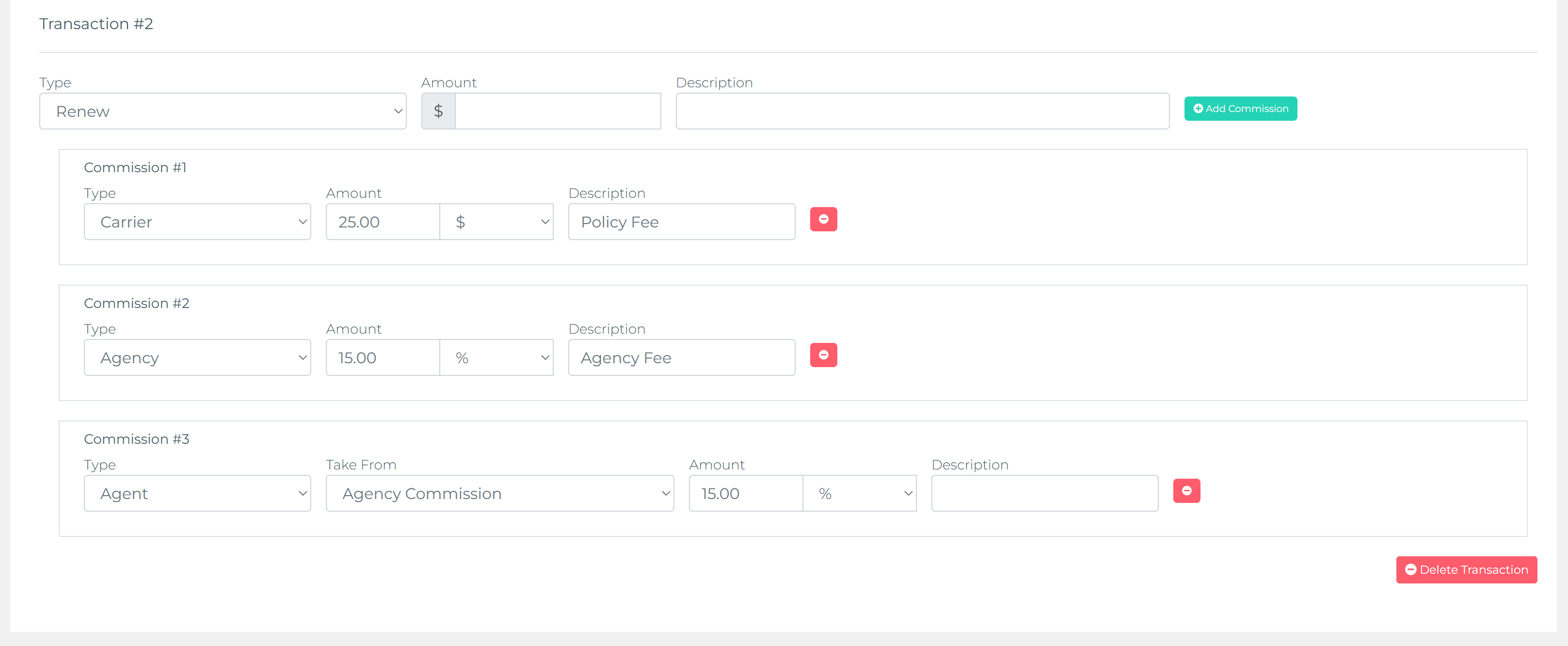

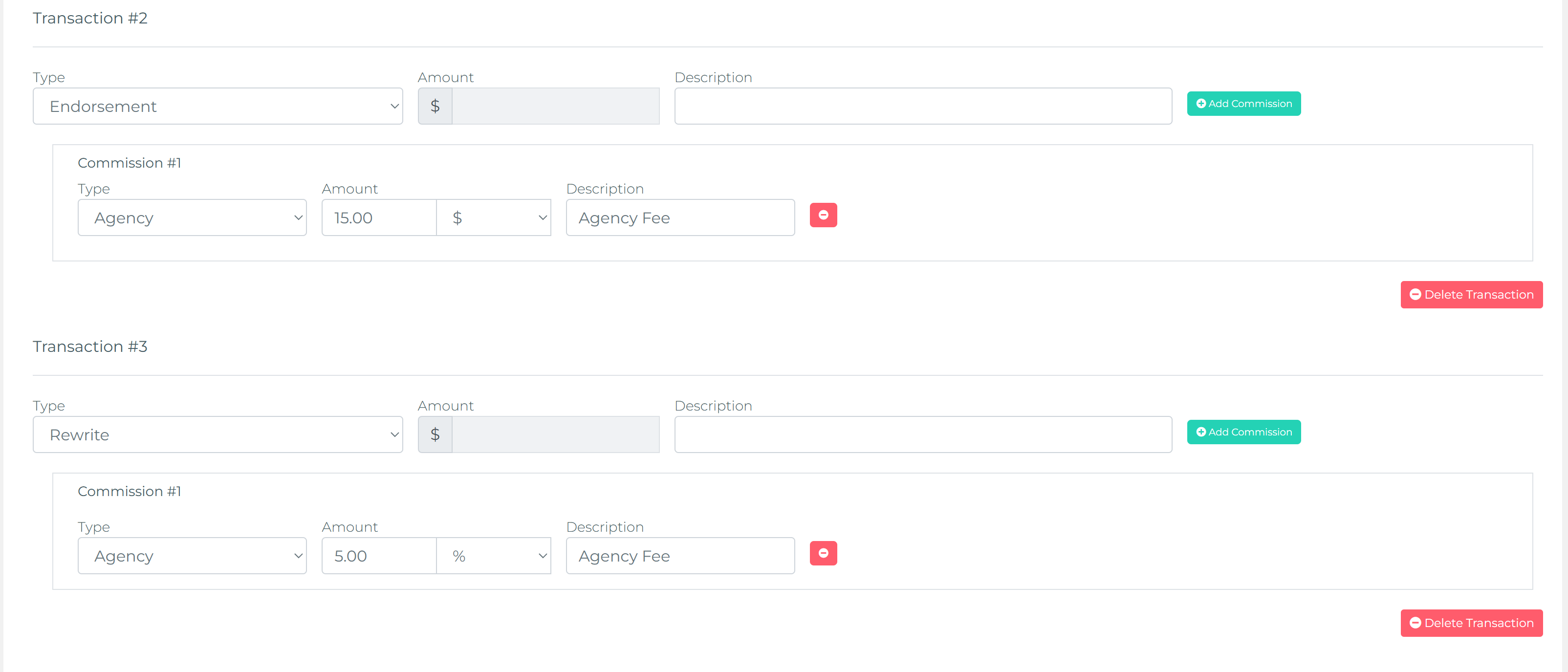

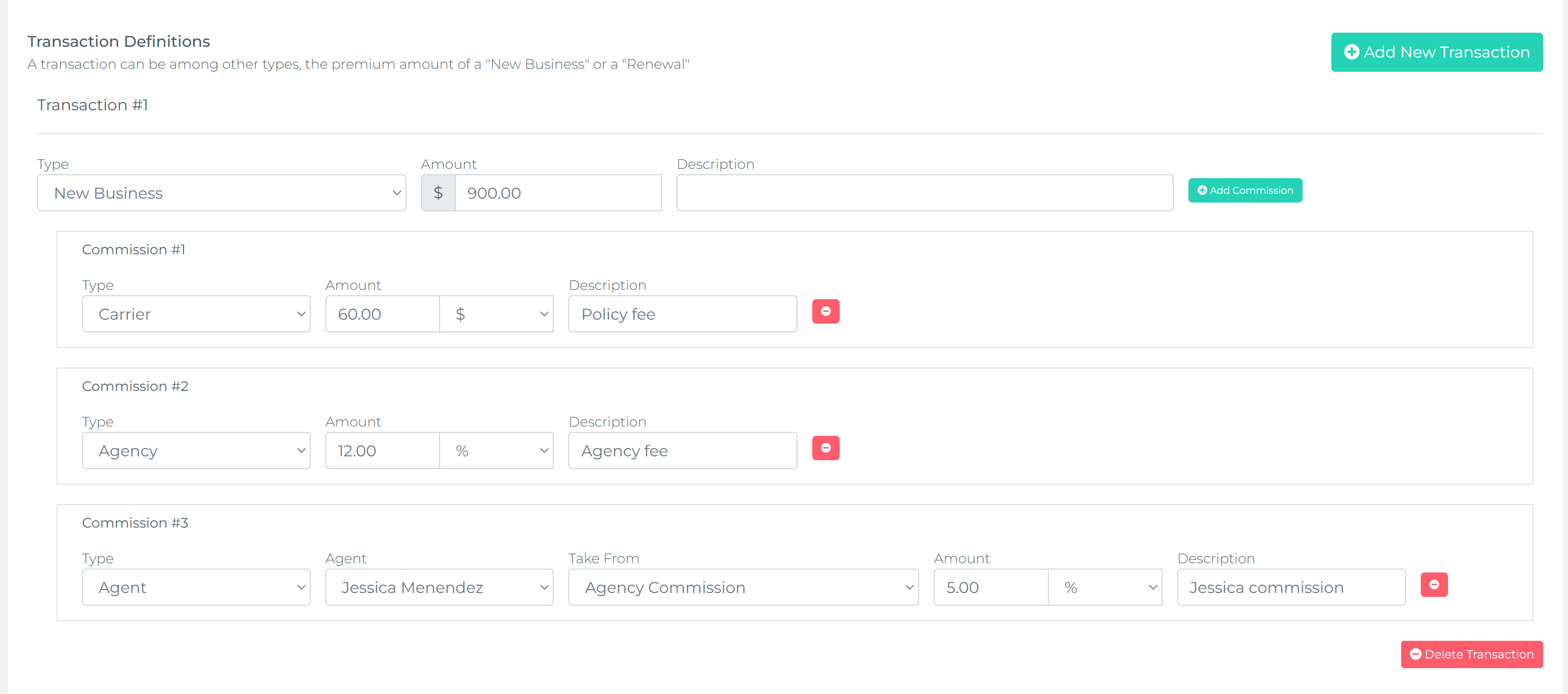

Transaction Definitions (Product-Level)

Inside a Product you attach transaction templates for the core lifecycle types only: New Business, Renewal, Endorsement, Rewrite. Each template pre-binds fees (policy, processing, service, financing), agency + agent commission layers, and any carrier/market fees you want consistently posted. When an agent selects the product during policy creation or renewal, these transactions (and their commission records) are auto-generated—no manual line building. Adjust-only types like Refund, Installment, Fees, Taxes are not modeled at the product level; they appear later as schedule entries or ad‑hoc adjustments, keeping the product clean and reusable.

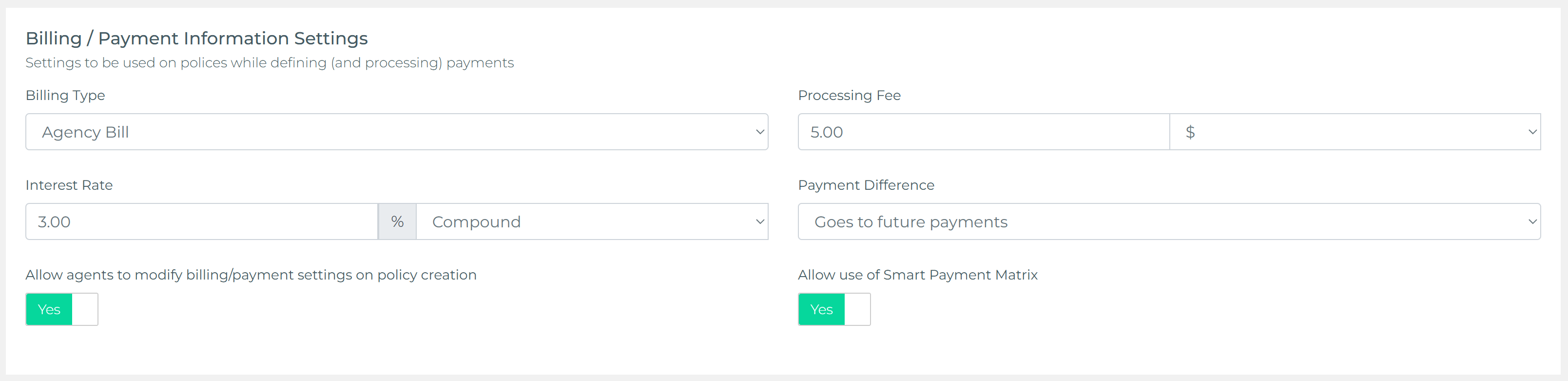

Billing & Payment Defaults

The billing section of a Product defines how the Smart Payment Matrix seeds a schedule: Billing Type (Agency Bill vs Direct Bill), Processing (per‑payment) Fee, Interest Rate (for financed agency‑billed policies), Default # Payments, and tolerance logic for Payment Differences. For agency‑billed products, these defaults produce a first schedule that is already amortized and fee‑correct. For direct‑bill products, keep interest blank and usually omit a processing fee—most or all payments flow externally so a schedule isn’t always needed.

- Billing Type: Choose Agency Bill only when you actually collect installments; otherwise Direct Bill keeps UI noise down.

- Processing Fee: Only add if charged on every agency‑collected payment—never duplicate with a manual fee later.

- Interest Rate: Set only when you finance; zero or blank means no amortization applied.

- Payment Difference Handling: Decide how under/over payments allocate (spread, roll to next, or disallow) so staff actions are consistent.

- Allow Smart Payment Matrix: Disable only for products that never require internal schedules (pure direct bill).

Payment Difference options

- Goes to future payments: Evenly amortizes variance across remaining installments—smoothest schedule.

- Goes to next payment: Rolls entire variance into the very next installment—creates a temporary spike/dip.

- Not allowed: Rejects mismatched payments; use only when strict invoice matching is mandatory.

Choose the least disruptive default for front‑line staff & customers.

Advanced Transaction Modeling Scenarios

Patterns that reduce manual tweaks during creation, renewal and endorsements:

- Tiered New vs Renewal Fees: New Business template includes policy+processing fee; Renewal drops policy fee but retains modest service fee.

- Lean Endorsement: Only delta‑driven lines; excludes one‑time new business fees to prevent double charging.

- Rewrite as Fresh Start: Treat rewrite like new business with full commission recalculation, preserving original policy history for analytics.

- Surcharge Isolation: Split premium into base + surcharge transaction so surcharge profitability is reportable.

- Multi‑Agent Potential: Product template defines agency share + placeholder agent layer; real producing/servicing agent splits finalized at policy creation.

Link to Payment & Commission Automation

When an agent selects the product during policy creation, the system pulls every configured element: transactions for the correct business type, commission distributions, fees, and Smart Payment Matrix seeds. Skipping product selection forces manual entry, introducing delays and errors—and inconsistent reporting classifications.

Common Mistakes & How to Avoid Them

- Too Many Products: Merge if only difference is a temporarily waived fee.

- Missing Endorsement Template: Leads to manual fee/commission lines—add a lightweight endorsement transaction profile.

- Leaving Interest Blank for Financed Line: Schedule later “fixed” manually; set a realistic default upfront.

- Free‑Form Terms: Agents typing “Annual”, “annual”, “1 Year” fragments reporting—restrict to a controlled list.

- No Test Policy: First live use reveals gaps; always test once.

Lightweight Versioning Strategy

When a structural change is needed (new commission model or fee introduced), clone the existing product, update the fields, and mark the old one inactive after remaining in‑flight renewals are processed. Keep the slug stable for the active version if possible; rely on an internal version note or description for historical clarity.

Quick Modeling Checklist

- Carrier & line confirmed

- Allowed terms pruned & default set

- Business type transaction templates attached

- Agency + agent commission layers balanced

- Fees centralized (no policy manual placeholders)

- Payment defaults (interest, payments, processing fee) set

- Sample policy test passed (transactions + schedule)

- Old similar products reviewed/merged

Glossary (Plain Language)

- Business Type: Describes the stage of the policy (e.g., New Business, Renewal, Endorsement).

- Transaction Template: Predefined bundle of amounts (fees, commissions) the system can auto add.

- Processing Fee: Per‑payment agency fee (optional) applied in schedules the agency manages.

- Interest Rate: Percentage used when agency finances the premium over multiple payments.

- Allowed Terms: The exact term options agents can pick (keeps reports consistent).