The Renewal workflow creates a new policy term for an expiring one. The agent only supplies the new premium (and, if needed, the commissioned agent). The Renewal transaction, commission rows, and payment schedule (if a Smart Payment Matrix applies) all generate automatically from existing templates and rules.

When to Use Renewal

Start a Renewal as the current term nears expiration and coverage should continue without rewriting the policy structure.

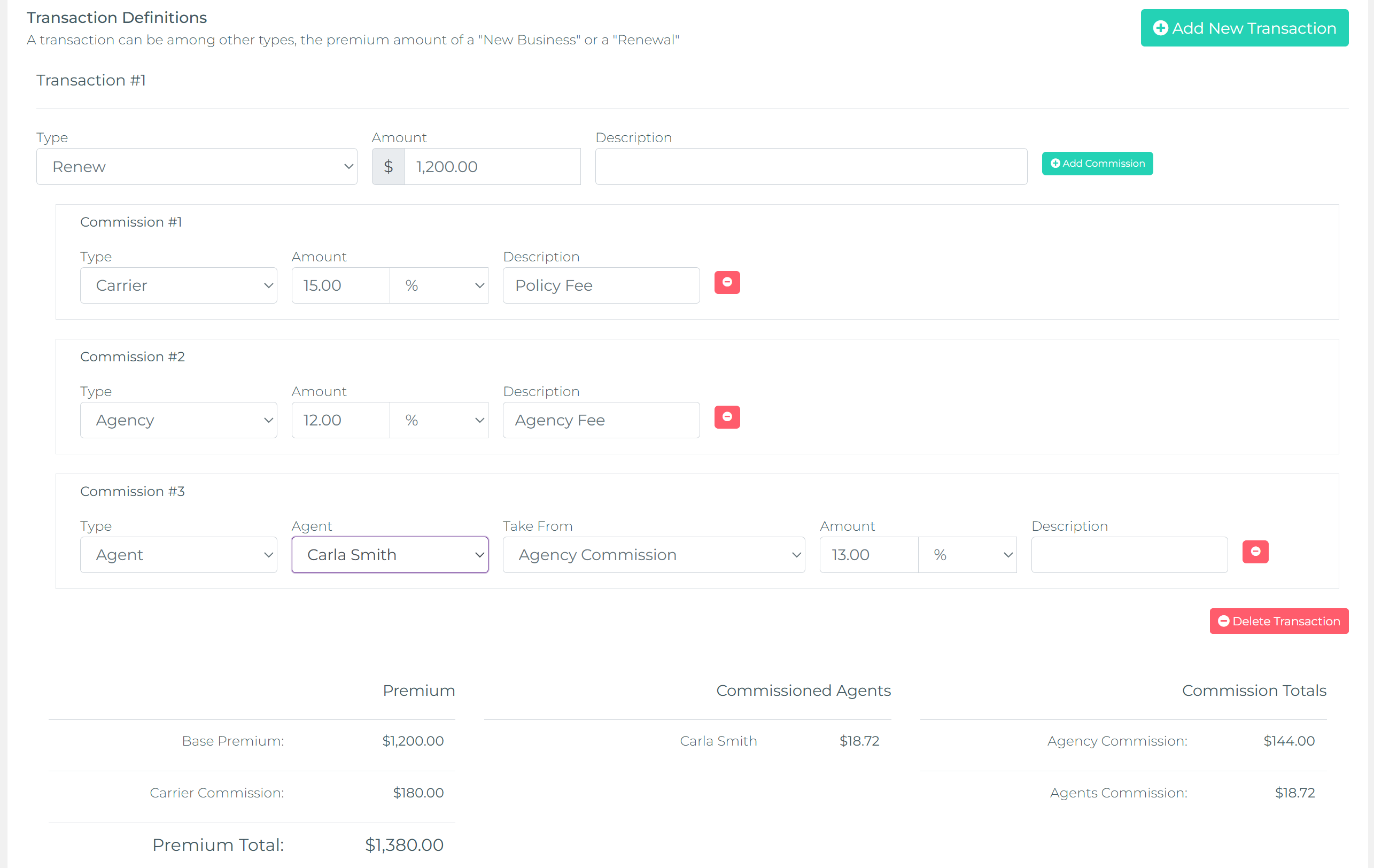

What Auto‑Populates

- Core policy data carried forward (no retyping static info).

- Business type set to Renewal automatically.

- Renewal transaction inserted if a Renewal template exists in the Product Definition.

- Commission rows generated beneath the transaction from existing commission definitions.

- Payment schedule generated immediately if a Smart Payment Matrix applies.

- Totals recalculated from the entered premium.

Agent Inputs Required

- Enter the new premium amount.

- Select/confirm commissioned agent (if commissionable and not defaulted).

Process Steps

- Click Renew on the expiring term.

- Review pre-populated fields.

- Enter premium and commissioned agent (if needed).

- Verify generated Renewal transaction + commission rows.

- Review payment schedule (if matrix-driven).

- Save to finalize the Renewal term.

Commission Handling

Commission rows derive from the same definitions as prior terms; only the premium change affects amounts. This promotes consistent payout logic without manual recalculation.

If multiple producing or servicing agents need to share the Renewal commission, add additional Agent commission rows beneath the generated ones and allocate percentages (or amounts) so the total still matches the defined payout. The base agency layer stays intact; you are only distributing the agent portion across multiple entries. Avoid cloning the product—multi‑agent splits belong at the policy term level.

Payment Schedule

When a Smart Payment Matrix applies, installments (count, spacing, due dates) are produced instantly. Adjusting the premium redistributes installment amounts automatically.

If no matrix is enabled for this product (direct bill or intentionally simple billing), the Renewal confirms faster because the system skips schedule generation. After creation, agents can manually record or add individual payments from the policy page using the Simple/Manual Payments approach—appropriate when the carrier bills directly or when only a small number of irregular payments will occur.

Audit & History

The prior term remains intact for reporting. The Renewal term continues the lifecycle; mid‑term changes afterward use the Endorsement workflow and stay isolated from the base Renewal transaction.

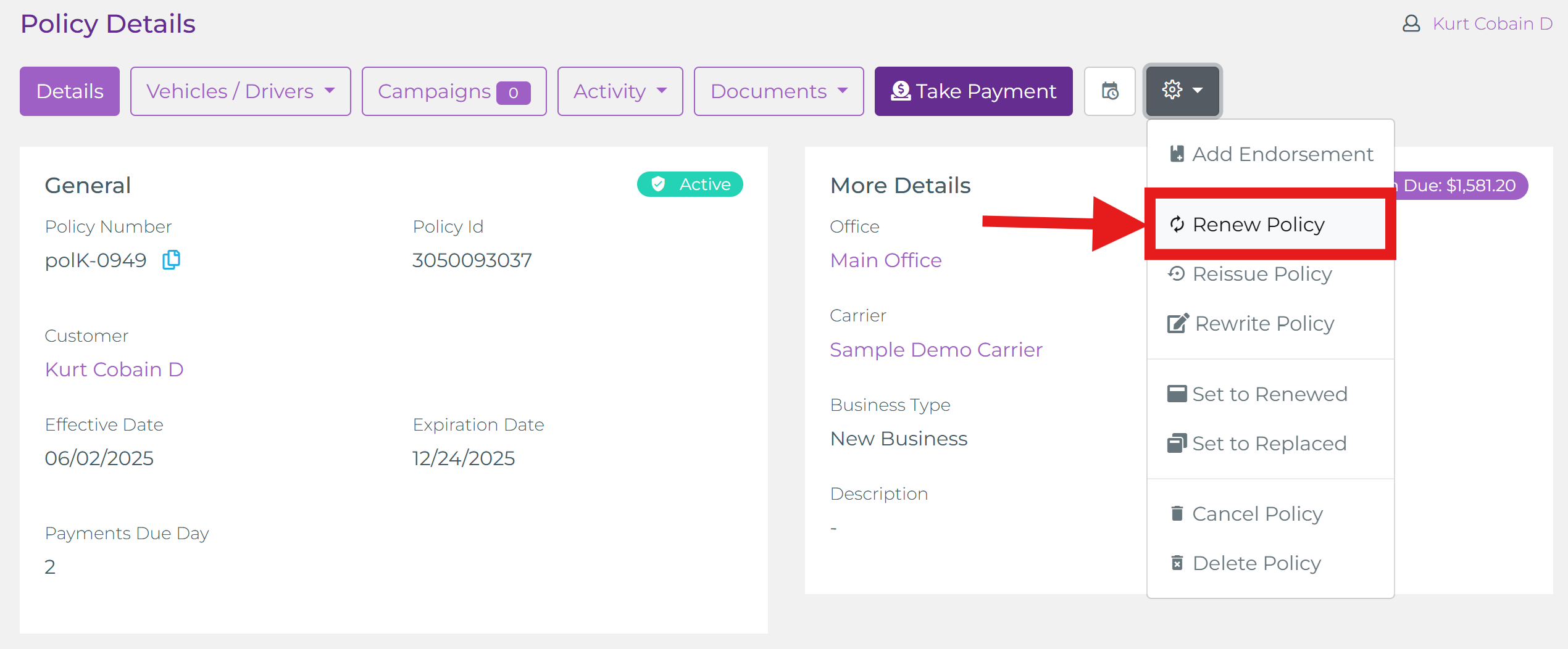

Accessing the Renewal Action

Use the contextual menu (or action button) on the expiring term to initiate the Renewal. This keeps the workflow explicit and prevents accidental rewrites.

Renewal Transaction & Generated Details

After selecting Renew, the system creates a new term and injects a Renewal transaction. Enter the premium (and commissioned agent if required). Commission rows and (when configured) the installment schedule appear instantly—no manual line creation.

Tip: If installment strategy differs for renewals (e.g., fewer payments for returning customers), define an alternate Smart Payment Matrix and map it in the Product Definition—avoid manual edits.