Add a Policy Endorsement

Use an endorsement to adjust a policy mid‑term when a change increases or decreases premium, fees, or commissions (vehicle added/removed, coverage change, surcharge added, etc.). Endorsements keep the original policy history intact while adding delta transaction lines.

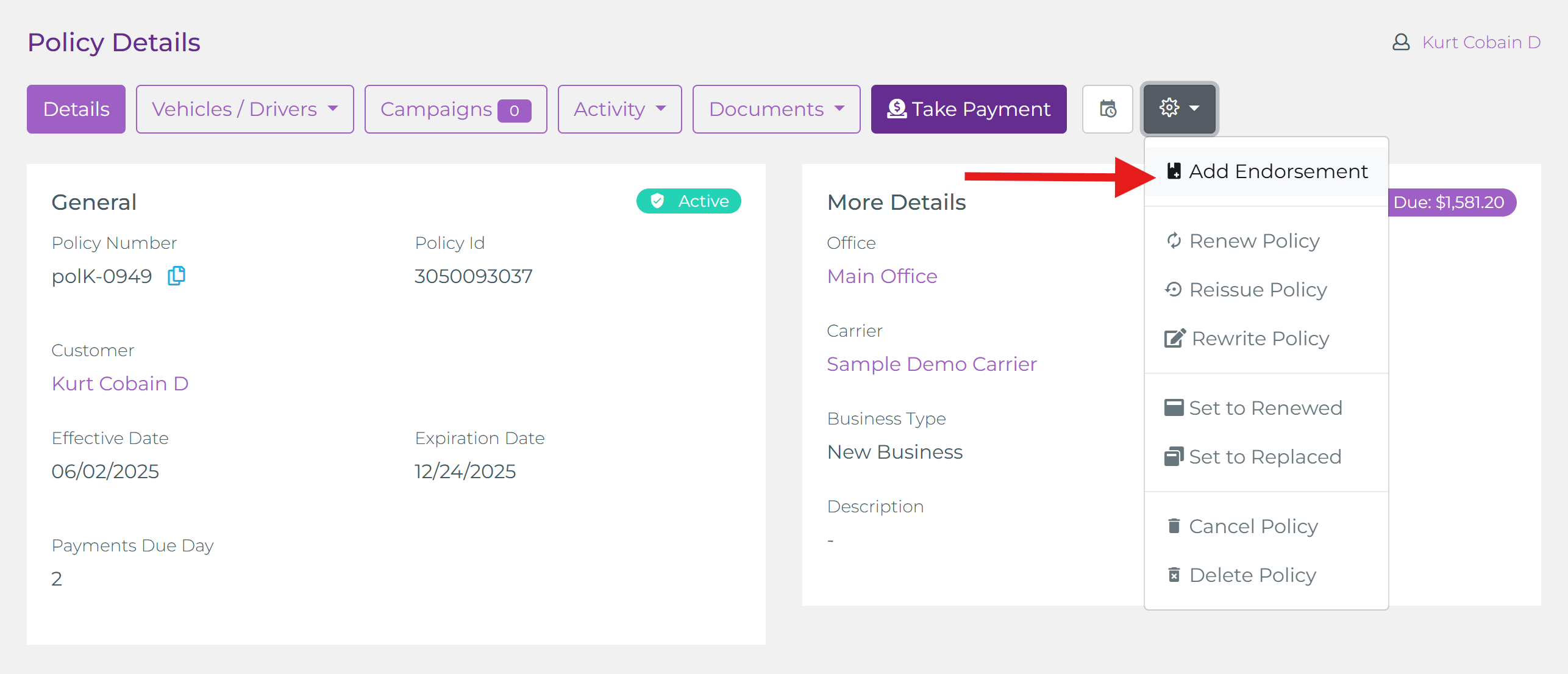

Where to Start

From the Policy Details page click the gear action menu and choose Add Endorsement. This opens policy edit mode directly on the Transactions section with a new endorsement bundle inserted.

What Happens Automatically

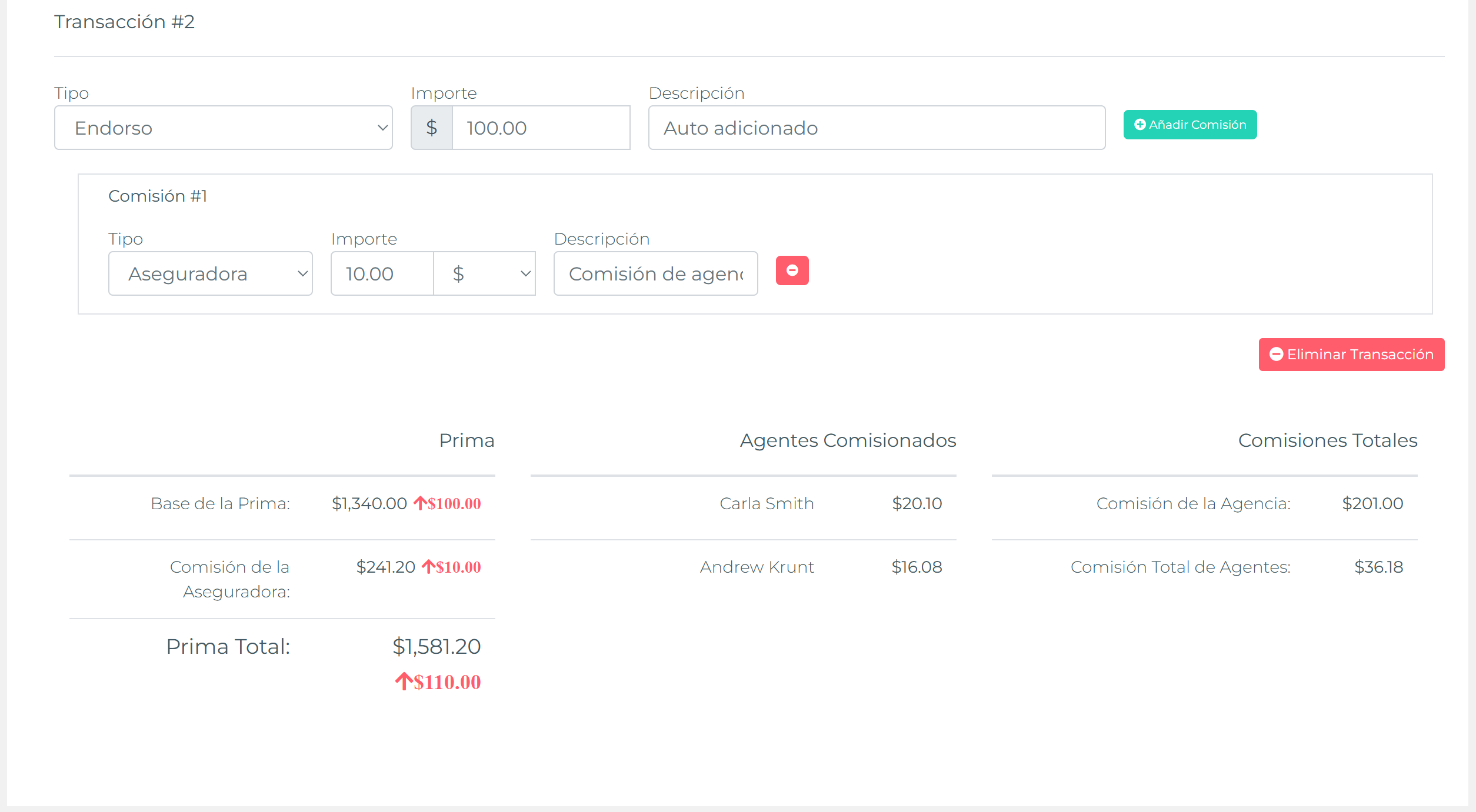

- Endorsement Transaction Lines: A dedicated endorsement transaction item group is added (usually empty amount placeholders).

- Commission Items: Related commission entries appear beneath the new transaction lines reflecting product commission structure.

- Delta Modeling: Only the net change (positive or negative) should be entered—never re‑enter full original premium.

Entering the Change

Type the delta amount (positive for increases, negative for reductions) in the endorsement transaction lines. The commission rows automatically recalc based on the product’s commission layers; adjust only if this specific change should alter agent share.

Recalculating the Payment Schedule

If the policy uses the Smart Payment Matrix, the schedule can absorb the endorsement difference evenly or in the next payment depending on the product’s Payment Difference Handling setting.

- Automatic Recalc: In many cases the matrix recalculates immediately after saving the endorsement lines.

- Manual Recalc: If not auto‑applied, click Recalculate under the payments section to update remaining installments.

- Negative Delta: Future installment amounts reduce (spread) or next payment decreases if handling is “Goes to next payment”.

- Positive Delta: Additional amount distributed across remaining installments or added to next payment per handling rule.

Validation Checklist

- Endorsement delta lines saved (positive or negative as needed)

- Commission amounts reflect new delta

- Payment schedule recalculated (if Smart Payment Matrix enabled)

- Description concise & meaningful

- No original transaction amounts altered

Troubleshooting

- Schedule didn’t change: Click Recalculate or verify product Payment Difference handling allows spreading.

- Commission looks off: Confirm commission tiers are delta‑based (not cumulative) for endorsement lines.

- Negative delta ignored: Ensure handling isn’t set to disallow differences or schedule is unlocked.